For Lead and Project Partners

Options for reporting closure costs in Jems

Closure costs refer to activities such as preparing and submitting the last joint activity report (JAR) and joint finance report (JFR), as well as the controller’s costs for verifying the expenditure of the last reporting period. Costs referring to these activities are eligible and must be paid by the deadline for submitting the last joint activity and joint finance reports as specified in the subsidy contract. If the Managing Authority/Joint Secretariat (MA/JS) grants an extension of the deadline for the submission of the mentioned reports (any of the two), the later postponed date applies.

There are two possible approaches for reporting the closure costs related:

Option 1 – Include closure costs in the partner report of the last reporting period

Closure costs can be reported together with implementation costs in the partner report for the last reporting period. In this case, the partner must include all the costs before submitting the partner report to the national controller, which delays the reporting and verification processes. The national controller validates both implementation and closure costs and issues one certificate of expenditure. The LP includes the certificate of expenditure in the JFR for the last reporting period, which is then submitted to the JS.

Option 2 – Create a separate Partner Report for closure costs

Alternatively, in addition to the partner report related to the last reporting period, the partner prepares a separate Partner Report specifically for the closure costs. In this “second” partner report for the last reporting period, the project partner includes, in the list of expenditure under the relevant cost category, only the cost items related to the project closure. The national controller validates these costs and issues a separate certificate of expenditure. The LP includes both certificates of expenditure in the JFR for the last reporting period, which is then submitted to the JS.

The project partners shall follow the guidance of their national controller in opting for one of the two approaches above. However, since the procedure as described in option 1 delays the verification procedure, it is recommended to opt for option 2 and include the closure costs in a separate partner report.

Creating a separate partner report for closure cost

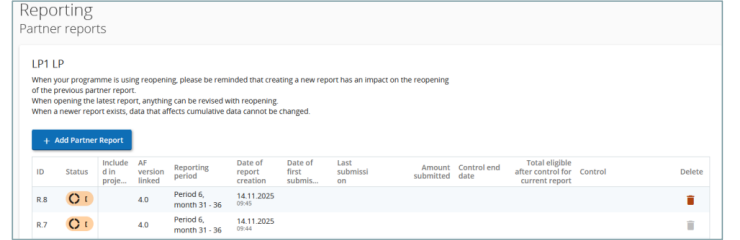

Go to the reporting section.

Click on “+Add Partner Report”.

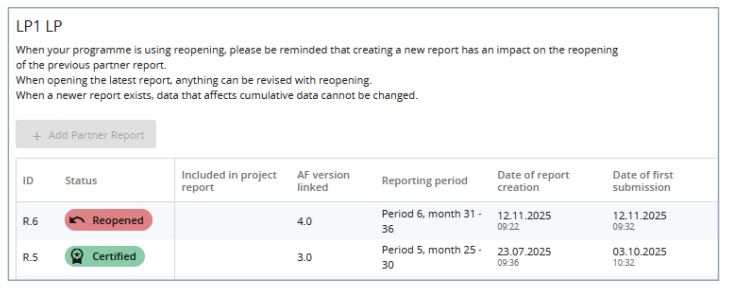

Note: Partner report creation is not possible while the latest partner report is in status Reopened.

This means that one has to either simultaneously create both partner reports (i.e., the partner report related to implementation costs and the one for closure costs) or create the one for closure costs at a later stage (e.g., as soon as the one on implementation costs is submitted to the national controller or once the implementation costs report is verified by the controller).

The partner report is created and automatically numbered (ID in ascending order R.5, R.6, R.7, etc.). The partner report ID does not reflect the reporting period.

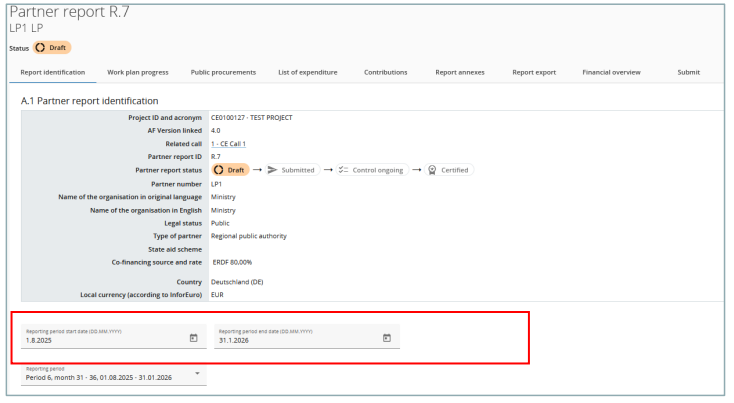

Including the reporting period dates

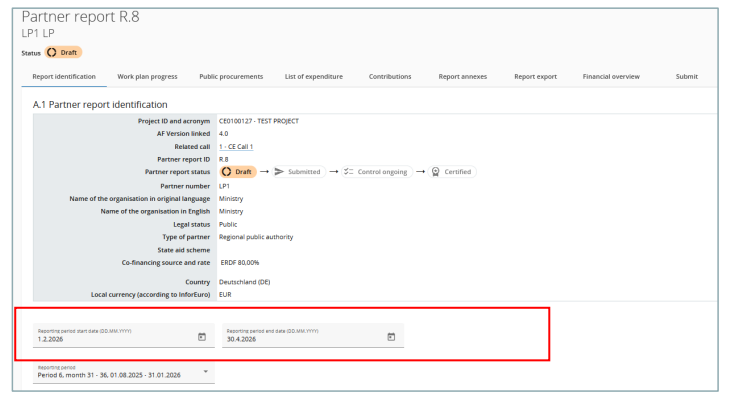

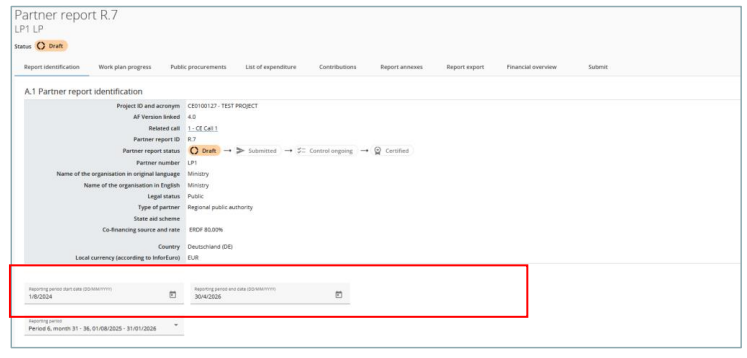

The reporting period start and end dates need to be defined in the partner report.

In case of option 1, the start date should be the same as that of the last reporting period and the end date should correspond to the three months following the end of the project.

In case of option 2, for the closure costs, the start and end date should correspond to the three months following the end of the project.

In both options, the reporting period should be the last period of the project

Option 1 reporting dates:

Option 2 reporting dates:

Reporting dates for the last period of the project

Reporting dates for the closure costs